In the endeavour to reduce emissions and the dependence on fossil fuels, many governments have been adopting preferential policies for green vehicles, while car-makers are increasingly seeing the value of turning green and coming out with environment-friendly vehicles. However, in Vietnam, the policies to support green vehicles are still lacklustre.

Eco-friendly vehicles

The emergence of hybrid electric vehicles (HEVs) is deemed as a breakthrough in the automobile industry offering significant benefits by reducing fuel costs and mitigating environmental damage.

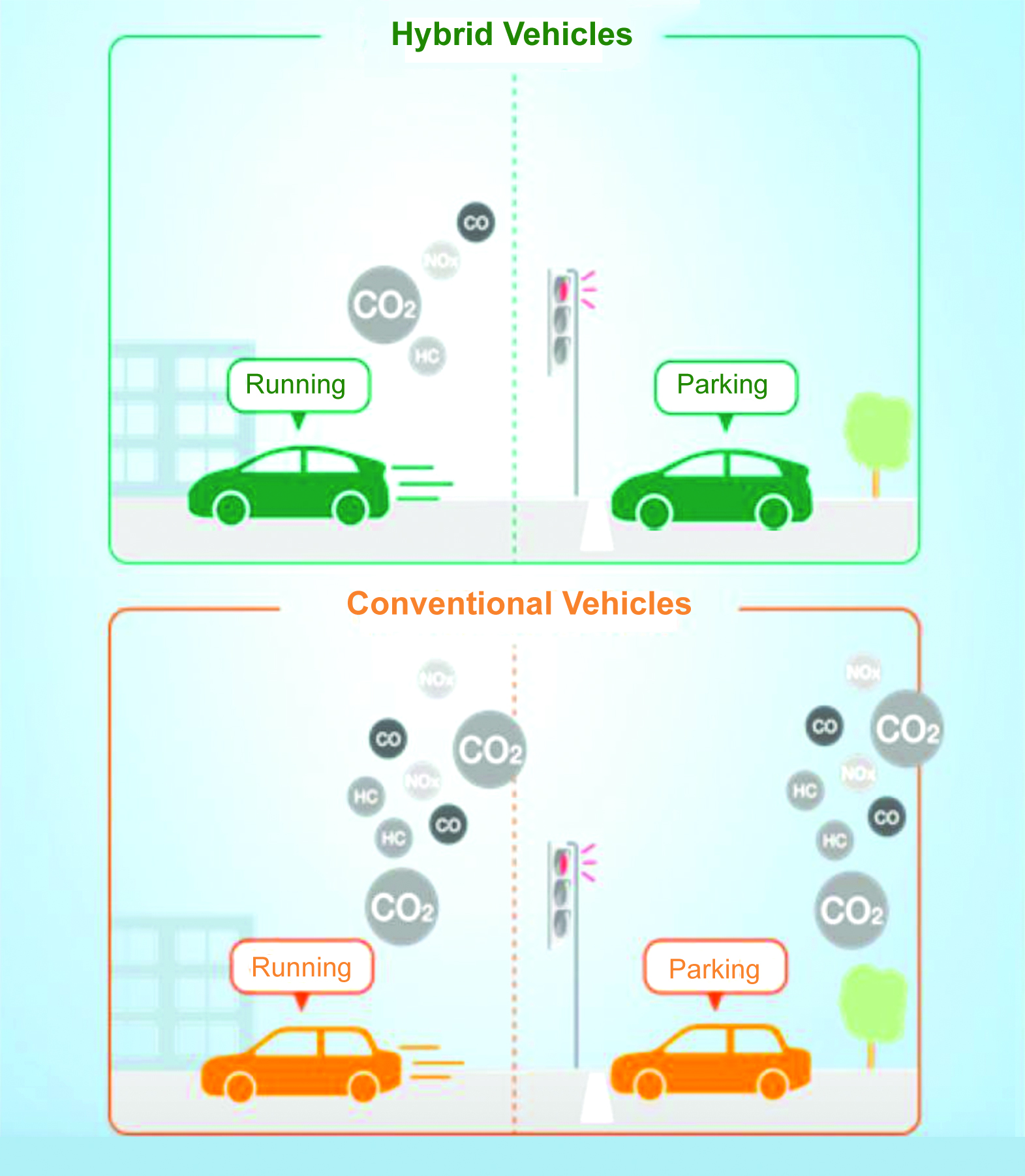

Unlike conventional fuel-powered vehicles, hybrid vehicles are a technological leap forward with a fuel-efficient combination of using both an electric motor and an internal combustion engine. These cars use petrol or diesel to power internal combustion engines and use electric batteries to power electric motors. They are more fuel efficient than conventional cars and therefore produce less pollution and harmful emissions.

Electric vehicles (EVs) as well as hybrid vehicles (including plug-in Hybrid Electric Vehicles) are green and ensure functionality with the added boon of environmental friendliness and well-performing operational features.

Recognising the benefits of environmentally-friendly vehicles in general and hybrid vehicles in particular, many governments have introduced regulations and policies to encourage the development of these vehicles. Specifically, they provide favourable conditions, such as lowering tax rates or even giving straight-out exemptions, with an aim to encourage automakers and traders to produce and sell green vehicles.

Tax incentives for green vehicles are a long-standing financial incentive for consumers. In addition to the form of registration fee reduction (in Hungary, Greece and Ireland), other preferential tax policies include road tax reduction (in Switzerland, Korea, Italy), tax credit (the US), even tax exemption (Japan). Tax incentives are also an important tool in stimulating consumer demand for green vehicles as well as encouraging firms to invest, design, and produce state-of-the-art models with high performance and good fuel efficiency.

Tax incentives also indirectly contribute to the protection of the limited fossil fuel resources, which are non-renewable and will one day run out. Thanks to the combination of internal combustion and electric power, hybrid vehicles can save about 20-30 per cent fuel compared to petrol and diesel vehicles in the same line.

On the other hand, the use of “green vehicles” instead of conventional vehicles also contributes to environmental improvement and the reduction of carbon and greenhouse gas emissions.

Pressing need for incentives

In France, the financial incentive for replacing gasoline and diesel engines produced before 2005 with EVs or HEVs is €10,000 ($11,000).

Engine models produced before 2005 are also deemed to emit toxic gases (PM2.5 and PM10) that lead to the deaths of thousands of people in China alone.

Not only benefiting consumers and the environment, the application of tax incentives also create favourable conditions for the automobile industry’s development, particularly for the environmentally-friendly vehicle industry.

In India, the automobile industry accounted for 7.1 per cent of the country’s GDP in 2015. The consumption of hybrid vehicles increased from 16,513 vehicles in 2014 to 65,224 in 2015.

In Southeast Asia, Thailand is also ahead of the trend and has already set the roadmap for the development of its electric vehicle industry. The Thailand Board of Investment has introduced a 15-year tax incentive scheme to encourage businesses to produce green vehicles. In addition, Thailand also applies preferential tariffs to vehicles based on CO2 emissions.

Accordingly, hybrid vehicles with engine capacity not exceeding 3,000 cc are subject to a local tax rate of 10 per cent, while the rate for fuel-poweredvehicles of the same bracket is 30-40 per cent.

In Vietnam, the government is also catching up with the trend of “green vehicles” and promulgated tax incentives for hybrid vehicles. However, the implementation of these policies has so far been difficult due to an unclear definition and understanding of what is a hybrid vehicle.

“I think that the current Law on Special Consumption Tax that is applicable to green cars is quite inflexible. For example, it makes an issue of where the hybrid vehicles get the electricity from. Vietnam mainly use hydropower, thermoelectricity, and electric generators that are operated by diesel or gasoline, which cause environmental damage on a daily basis,” said economist Vu Dinh Anh.

Therefore, Anh was urging the Vietnamese government to craft far-sighted policies and implement them right away as there are not many hybrid cars in Vietnam yet and a clear, encouraging legal framework would go far in helping hybrid vehicles take firmer roots.

By Hoang Nam / VIR